In response to the escalating demand for an efficient dispute and fraud management process, financial institutions are seeking assistance navigating increased dispute volumes and elevated cardholder expectations. Recognizing this critical need, PSCU/Co-op Solutions has committed a multimillion-dollar investment to enhance the dispute management framework, partnering with top technology companies to streamline the reporting process and address disputes effectively.

This initiative will allow financial institutions to streamline their operations and significantly enhance the cardholders' experience by providing a more effective and efficient dispute resolution process.

We will provide updates as new functionality enhancements are rolled out. Please visit this site for updates on this initiative.

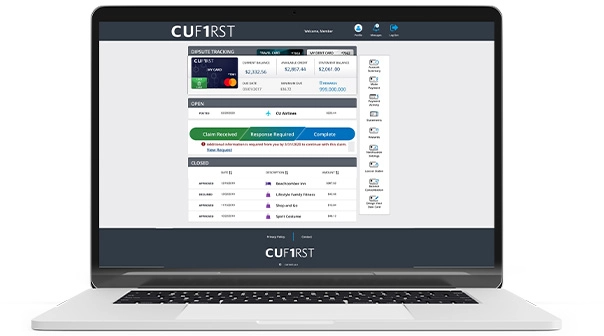

Our application for financial institutions revolutionizes the way non-fraud and fraud case management is handled. Leveraging advanced technology and process automation streamlines the entire process for optimal efficiency.

Key Features of the new disputes management solution include:

A centralized location for Optis Credit & Debit Fraud and Non-Fraud

Streamlined case submission process

Robust case search and document upload capabilities

Communication capabilities between the FI and the platform

Real-time connection to Visa and Mastercard for case submission

All documents affiliated with the case are available to view or print

A case history of events

Branded color letters and emails

Chargeback automation

Updated reports in Member Insights

RegZ and RegE compliance for letters and reporting

The overall opinion from our pilots and early adopters has been consistently positive:

Debit Non-Fraud and Fraud Cases

Additional Information will be

provided as available

Our case management application significantly benefits financial institutions and cardholders, ensuring an efficient and transparent cardholder experience. With our application, your financial institution and the cardholder will have immediate access to their case status through the cardholder's preferred channel, including seamless integration with association platforms for real-time updates. We are committed to continually enhancing our application to meet evolving needs.

For your financial institution, the optimized disputes process will provide a consolidated non-fraud and fraud application for credit and debit disputes and centralized case status reporting through the Consolidated Disputes application.

For your cardholders, the application will provide real-time visibility into case status, improve the speed of case resolution and give cardholders a choice of channels for interactions around their cases.